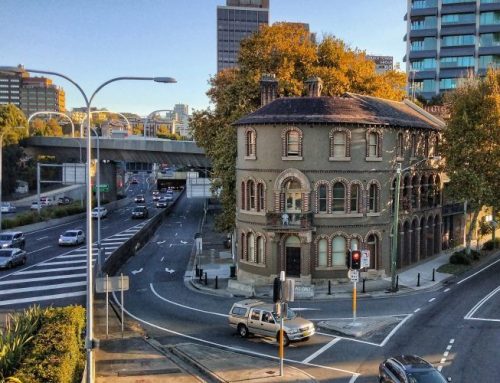

The business in question was operating from a well-known retail building in North Sydney which was being compulsory acquired by the NSW Government which commenced a new public transport project – Sydney Metro City and Southwest which will deliver 30 kilometres of metro rail between Chatswood and Bankstown. It will include a new crossing beneath Sydney Harbour and new railway stations on the lower North Shore and CBD.

As part of this matter our valuers performed extensive research of the North Sydney retail market to understand the levels of compensation the business was entitled to. When investigating the market our valuers conduct interviews with lessees and lessors, prominent real estate agents, conduct inspections of comparable properties, search leases and consider market evidence and review research by large real estate research providers such as Core Logic and Colliers such as their Retail Capital Markets Investment Review 2016 (found here). The valuation was completed in early October and the following market overview was provided in the valuation concerning the North Sydney Retail Market with a food court/takeaway/restaurant property segment flavour flavour.

In Sydney there remains a high demand for inner city living. This is supported by rapid increases in residential housing values adjacent to and within the CBD. There remains some focus on removing and converting CBD office stock in favour of residential development. This is despite an increase in white collar employment driving falling vacancy of CBD office space. This situation brings the need for more amenity and transportation services within the CBD to service the increased residential and workforce populations. (Colliers).

This property is positioned within North Sydney CBD surrounded by predominately office, commercial and retail development. The Property is positioned within a “food court” setting with peak trading times during the lunch service period. This suggests that the dominating drivers of trade for this sector of business would be the occupancy rate of the surrounding office development, the disposable income of consumers and the surrounding development that can accommodate business competitors.

The latest Property Council of Australia vacancy numbers indicate a decrease in the overall vacancy rate for the combined North Shore market to the lowest levels since 2001, falling from 9.6% to 8.0% in the last 12 months. B Grade rents are currently starting to increase and incentives are expected to fall as vacancy in the medium term stays low. This signals that there is a potentially increasing customer pool for Eat-In and Take-Away Restaurant services from the growing employment base in this location.

From a macroeconomic perspective, retail consumers in the target area continue to benefit from low interest rates, rapid appreciation of house prices and creation of whiter collar jobs due to Australia’s transition from a resource to a service based economy and on the back of the above mentioned post GFC recovery. This is also supported by positive business sentiment levels which have improved over the last three years. The recovery of business conditions in this time frame, particularly in the service sectors that dominate the North Sydney office space market point towards ongoing levels of discretionary spending by The Business target market on Eat-In and Take-Away Restaurant services.

Colliers Retail Capital Markets Investment Review 2016 indicates that the NSW annualised retail sales turnover growth rate was 4.89%, compared to the national retail sales growth rate of 3.41%. According to this publication the cafes and restaurants segment account for 14% of total retail sales volumes with sales of approximately $3.5 billion up from $2.5 billion in 2009 with “The current rate of sales growth in this sector has increased to 3.9% from 1.7% at the beginning of the calendar year” (Colliers).

Agents report that retail premises that are suitable for Eat-In and Take-Away Restaurant services in North Sydney are in high demand in North Sydney. Due to the specific requirements of fitting out a retail space for Eat-In and Take-Away services many retail and commercial spaces are not suitable for this use.

Based on the above research our opinion was that the demand for suitable retail spaces for Eat-In and Take-Away uses was strong at the time of valuation, this means that suitable compensation needs to be provided to the business as it competes with other potential lessees to find an alternative property for its operations.