On 17 May 2021, Justice Duggan, in the Land and Environment Court of NSW, handed down her decision in Eureka Operations Pty Ltd v Transport for NSW.

The decision reinforced the following important implications of sections 55(a) and 55(f), of the Land Acquisition (Just Term) Act 1997 NSW in cases related to the partial compulsory acquisition of an interest in land:-

- Where the land available to a Lessee has particular characteristics that enhance the trading potential of the highest and best use of the land then the market would pay more than the profit rental (as determined under section 55a) attached to that lease, and

- Valuation expert fees such (in the case of all compulsory acquisitions) can only be compensated under section 59(1) b where they are “qualified valuers” pursuant to the definition in section 59(2).

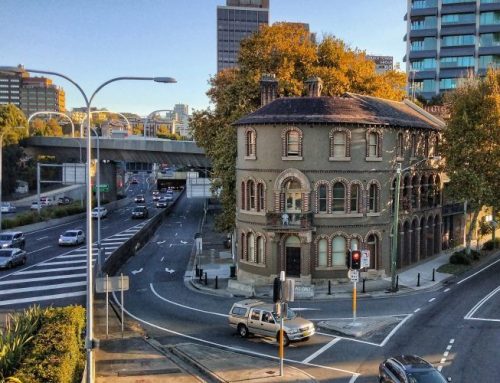

In this matter Eureka Operations Pty Ltd was a Service Station operator (Lessee) upon a site of which 15.3 square metres (of a total 1,519 square metres) was being compulsorily acquired. The site was located on a prominent intersection in Dubbo and the Public Purpose was identified as the upgrade and construction of the intersection (Works).

Traffic Experts, Colston, Budd and Rogers assessed that the Works would decrease the number of vehicles attending the site by 47.2% due to the changed traffic conditions. This was agreed and adopted by the Parties.

The case considered that the petrol station was a “Trade Related Property”. A Trade Related Property is defined as, any type of property designed for a particular business use and where the property value reflects the trading potential for that business, by RICS Valuation Global Standards, 31 January 2020. RICS also nominates the appropriate valuation of such trade related properties be an earnings-based methodology.

Duggan J found that compensation for the loss of value of the Lease should be determined under section 55(f): any decreases in the value of any other land of the person at the date of acquisition which adjoins … the acquired land by reason of the carrying out of, or the proposal to carry out the public purpose for which the land was acquired.

The reasons for her findings are detailed in paragraphs 71 onwards but the main points are summarised below:-

- The exercise is quite different from a s 55(a) determination of market value for two reasons –

- It relates to land not acquired,

- It requires attention to the loss relating to the retained land caused by the carrying out of or the proposal to carry out the public purpose not be the acquisition itself.

- The reference in s 55(f) to ascertain the change in value of the retained land is still a refence to the Lessee’s interest in land See United Petroleum at [25]

- What is required in the determination of the market value of the claimant’s interest in land is the detailing of factors that a potential purchaser would take into consideration in the price that the market would pay to attain that interest.

- In this matter the presiding judge considered this was best determined using the earnings of the business in a before and after scenario on a discounted cashflow basis (DCF) on a before and after basis for the following reasons:-

- The earnings generated in the “before scenario” were an expression of the highest and best use dictated by the locational features of the site, that is, the earning capacity of these types of sites exist largely independently of the identity of the operator. The lease holder is given the right to exclusive possession to carry out the use which enables earnings to be realised,

- The value of obtaining the lease is reflected in that earning capacity as a whole and not on isolated elements of earnings that are reflected in the quantum of profit rent,

- Intangible assets such as goodwill and brand recognition are accounted for in the after scenario,

- Fixed cost remains unchanged in both scenarios,

- Earnings before interest, tax, depreciation, and amortisation is a good indicator for the DCF of a service station under reasonable management.

Finally, in relation to expert fees and costs the following heads of compensation apply.

Section 59 (1) (a): legal costs reasonably incurred …in connection with the compulsory acquisition of the land.

Section 59(1) (b): valuation fees of a qualified valuer reasonably incurred by those persons in connection with the compulsory acquisition of the land (but not fees calculated by reference to the value, as assessed by the valuer, of the land),

Duggan J determined that where a legal practitioner determines that some additional advice is required from another qualified person (other than a valuer) to enable them to provide legal services advising on the compensation offer then those costs should be compensated under this head of compensation. On this basis the traffic expert fees were compensated under section 59(1)(a).

Duggan J however, found that the valuers fees could not be claimed at all under section 59 unless the valuer was “qualified”, and denied the forensic valuer’s costs.

Prepared by Nicole Adamson, qualified accountant and qualified valuer (as defined by section 59 of the Land Acquisition (Just Terms) Act 1997 NSW). If you have any inquiries about your compulsory acquisition, please contact our office so that we can assist.